Charts 1 and 2 – Broad Market Stuff…

Below the chart of S&P 500, we can see that the number of stocks above the 20, 50, and 200 moving averages (breadth) has been declining, while the price of the S&P 500 has closed higher.

What does this mean?

As the S&P 500 continues to get bid up higher, there are fewer number of stocks getting bids. The longer this goes on, the more unhealthy the market becomes. Right now, we don’t know if breadth will get worse as market continues to go higher, but if this divergence continues on, then we will get something similar to what we saw in 2021 and 2022.

What happened when the S&P 500 peaked in 2021 to early 2022–SPY kept going higher and higher while breadth continued to get worse and worse…

Charts 3 to 9 – A Case Study…

Bull markets, especially in the resource space, are vicious.

Take a look at coal producer Alpha Metallurgical Resources (AMR)…

From its March of 2020 low of $2, it is now trading at $371. That’s a 185x. However, the journey is not as easy as it may appear.

First, look at the ~18-month consolidation…

Let’s say you FOMO’ed and started buying AMR when it reached $100 (the left edge of the box I drew).

From there, you would have had to wait 18 months while the stock consolidated at its volume shelf of ~$150. Yes, you’d be up 50%, but what if you had gotten a little bit less lucky and FOMO’ed in at $150 instead of $100? You would have probably sold at either a slight loss or near breakeven during those 18 months of volatility.

But what if you had held on? Or maybe… what if you had just gone to the beach and didn’t bother to check your screens until today?

You would have more than doubled your money even if you had bought at $150.

My point is not just buy and hold.

For example, if you had FOMO’ed into OCO at $3.60, you’d be down around 90%.

Ha, I myself am down more than 50% on this position!

And so, the lesson here is not simply buy and hold. But rather, the lesson here is buy at the right times and then hold. This begs the question: What are the right times?

Well, while I think company and industry-specific fundamentals are super important, What is more important than that, I believe, is the supply and demand fundamentals of shares. What I mean is, if a stock has run out of sellers, assuming that the company does not constantly dilute the total number of outstanding shares, should there be significantly positive industry or company-specific fundamentals in the next fear years, buyers will come in and push the stock price higher. Note that stocks prices don’t always go higher when buyers come in. In our specific case, buyers are able to push the stock price higher because most of the sellers will have already sold their shares on the way down and/or towards the bottom. In other words, demand pressure must be much greater than the amount of pressure from increasing supply.

Going back to our example of AMR, it is clear that even if you were to FOMO in at $100 instead of $150, you would still be taking on much more risk (from a share supply and demand fundamentals perspective) because when so many people have bought shares, by FOMO’ing and buying shares alongside them, you are putting yourself at risk of the amount of pressure from increasing supply being much greater than the demand pressure, which will cause the price to cascade.

This is why these days, we only want to build large positions at cyclical bottoms. It is impossible to call what the bottom is, but if you even get it right remotely, you will make a lot of $$.

All this said, remember that bull markets are vicious, especially in the resource space. My example with AMR is also that during bull markets, there will be long periods of consolidations which can shake you out.

With commodities, we hope we won’t close our positions until the ratio gets to around 5 or so. Currently, we are still very far from that.

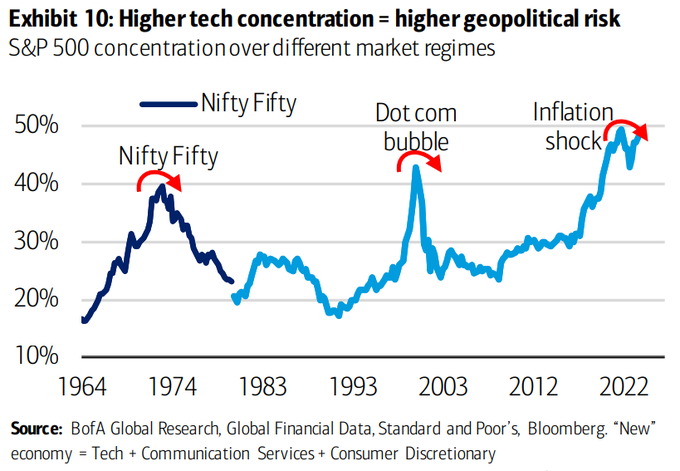

Hopefully, tech eventually gets sold off and gets reallocated into commodities…

Charts 10 to 18 – Uranium – It’s Go Time!!

After 18 to 24 months of consolidation (depending on how you count that period), uranium equities are finally going parabolic.

Take a look at URNM…

URNJ…

Our darling developer Bannerman…

Now, if you think this weekly candle is huge, I want you to look at the kind of move people experienced in BMN during the last bull market in the 2000s (where there was no uranium supply deficit).

Now, look at SPUT…

Now, we aren’t buying more uranium equities, but if you have not gotten positioned, the equities are where to start, as uranium equities are still very undervalued when compared to the price of the commodity itself.

Take a look below at URNM-to-price of uranium ratio…

Congrats to long-term holders of uranium. Nothing to do except hold. If you want, you can trim, as no one’s ever lost money by protecting profits. But… I believe now is the time to just sit back and wait. I think uranium equities have been lagging behind because we are still not in an environment where there is a lot of risk capital. And so, capital has been piling into the commodity itself, but not equities because no one wants to take on additional risk. Will this change? We certainly hope so. Heck, we don’t know anything more than buy what’s cheap and sell what’s expensive, so… that’s pretty much the only thing we know for sure that will increase our chances of making $$.

In the last uranium bull run, Cameco kept running higher for about 3 years straight…

Back-then explorer BMN’s run was much more compressed and ran for 8 months straight to its first peak. This was towards the end of the uranium bull cycle (remember that explorers tend to run last–and quickly!).

Now, if you were looking at some of the charts above and thinking… wow that’s a huge gap that will have to fill, just remember that PDN had a gap that wasn’t filled until 15 months later.

Like I said, all there is to do now is to sit and wait. Getting out too early is the biggest risk right now.

Chart 19 – Copper…

Copper still working out where it wants to go. Nothing much here except that many copper jr. mining equities remain extremely cheap.

Chart 20 – Silver…

Silver junior miners are still very cheap when compared to the price of silver.

Charts 21, 22, 23, 24, 25 – Crypto is Gonna RIP…

As a whole, the crypto complex has been getting a lot of capital inflows. The change of character on some of these crypto equities are insane.

Just look at that increase in volume in IREN…

Same with BTCS…

Galaxy Digital…

Ethereum looks so clean…

Same with Bitcoin…

I would buy more crypto, but they are just trading positions for me because it is hard to value tokens themselves. When I make some money from this cycle, I will rotate them into companies I like.

PS – Some Scripture…

Disclaimer

The information contained in this publication is not intended to constitute legal, accounting, or tax advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal , accounting, or tax advice or individually-tailored investment advice should be referred to lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice.

This publication makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and is for educational purposes only.

This publication is not, and under no circumstances should be construed as, a solicitation to act as a securities dealer or adviser. The opinions expressed in the publication are those of the publisher and are subject to change without notice. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.

TO THE FULL EXTENT PERMITTED BY LAW NEITHER, ALCHEMY OF INVESTING NOR CABBAGE CAPITAL LLC, NOR ANY OTHER PERSON OR COMPANY, ACCEPTS ANY LIABILITY WHATSOEVER FOR ANY DIRECT, INDIRECT, OR CONSEQUENTIAL LOSS ARISING FROM, OR IN CONNECTION WITH, ANY USE OF THIS PUBLICATION OR THE INFORMATION CONTAINED HEREIN. ALCHEMY OF INVESTING AND CABBAGE CAPITAL LLC EXPRESSLY DISCLAIM ANY GUARANTEES, INCLUDING, BUT NOT LIMITED TO, FUTURE PERFORMANCE OR RETURNS.

No part of this publication or its contents, may be copied, downloaded, stored in a retrieval system, further transmitted, or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means, except as permitted with prior written permission.

This publication is proprietary and limited to the sole use of Alchemy of Investing subscribers. Please do NOT post this on any website, forward it, or make copies (print or electronic) for anyone else. Each reproduction of any part of this publication or its contents must contain notice of our copyright. Any unauthorized downloading, re-transmission, or other copying, modification or use of the Trademarks, this publication or any of this publication’s contents may be a violation of statutory or common law rights which could subject the violator to legal action.

There is a risk in trading markets. We are not registered investment advisers. Do your own due diligence.