Charts 1 to 4 – Broad Market…

One can look at this and say, “Wow, so impressive!”…

In reality, the S&P 500 hasn’t done jack the past 6 years relative to real value…

Who knows, breadth also seems terrible when we look at the S&P 500 Equal Weight relative to S&P 500…

With my own set of indicators, we can see that breadth is indeed getting worse since December of 2023.

Yellow Line: % of Stocks Above 20 DMA

Turquoise Line: % of Stocks Above 50 DMA

Red Line: % of Stocks Above 200 DMA

Bottom Pane: # of 52-Week Highs Minus # of 52-Week Lows

Charts 5 to 9 – The Battle of the 2020s: Tech Vs. Commodities…

From Capitalist Exploits’s Christ MacIntosh…

“We highlighted a somewhat absurd comparison last time between NVIDIA and a smattering of Germany’s finest blue chips.

Keeping with that theme, here are a few stats that are bound to really impress folk at a cocktail party (or — depending on the company — ensure you don’t get invited back).

Also, keep in mind that it’s been a few weeks since we pulled these numbers. NVIDIA tacked on another $500 billion or so in market cap since then, making the already shocking contrast even more shocking (as if to prove our point about how out of whack the markets are).

Anyway, take a look at this (market cap figures for each stock/sector):

- NVIDIA: $2.36 trillion

- S&P 1500 energy sector: $1.99 trillion

- NYSE Gold Miners Index: $207 billion

- S&P 1500 Marine Transport Index: $9.2 billion

Put another way, you could own the entire NVIDIA.

Or you could own all the energy, gold, and shipping stocks combined, and still have a couple of billion in change.

In terms of risk versus reward, we know where we would rather be investing our money right now (and it’s not NVIDIA).”

Speaking of risk-reward, it’s pretty clear where the value lies…

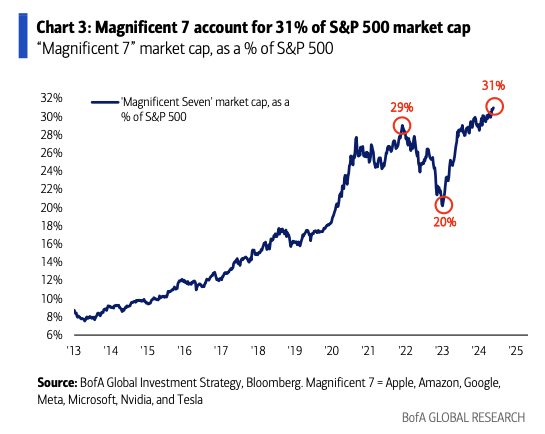

Plus, this kind of concentration of capital in one sector is VERY dangerous…

Here’s another chart for broader historical context of what tends to happen when the top 10% of stocks get insane flows relative to the rest of the U.S. stock market…

Even though the market has not come to its senses yet, over the past 4 years, inflationary assets have already been outperforming deflationary assets.

Plus, look at how commodities have been *silently* outperforming everything this year…

I–Cabbage–have been telling Josh’s dad (through un-cryptic “meows”) about the commodities bull market for a few years now. I told him about tankers, uranium, copper, gold, silver. Literally, everything we’ve been talking about here. Not one cent invested in any of these sectors. No, not one.

In hindsight, he can clearly see this bull market, but he still thinks it’s too risky now or that it’s about to end. This is a prime example of how staying “too careful” or being too risk-averse can make you lose out on gains of a lifetime. My hope is that none of us makes the same mistake, especially after a lot of AoI members got shaken out after the 2021-2023 drawdown–boy was that long and hard to stomach!

Lastly, I thought this was interesting (from Goldman Sachs)…

Charts 10 to 13 – Uranium…

Uranium equities relative to the price of uranium has broken out.

Over the past however many months, we’ve been talking about how uranium equities are cheap relative to the price of uranium. Right now, that is starting to show.

From Capitalist Exploits’s Chris MacIntosh (again) talking about how we are right in the meat of the uranium bull market…

“We dedicated an entire section to patience in our last issue, but let’s today look at a more practical example. A case study, if you will, from a sector that’s very near and dear to our heart — uranium, specifically Cameco.

Let’s say you bought Cameco back in 2000 at the height of the TMT bubble (24 March 2000). Somehow you had a brilliant insight that uranium would be a big winner over the coming months/years.

Fast forward four years and Cameco was up some 330%. You may have been thinking of getting out and not pushing your luck (not too dissimilar to how many folks are currently feeling about the magnificent run in uranium miners over the last few years).

Now, let’s take Cameco’s performance from March 2004 to March 2007.

As you can see, it ended up going up another 300%.

In other words, just when you got the jitters of being up too much in the trade, you were only half way through the cycle.

Today, we suspect the same thing is playing out once again and we are closer to half way through the current bull market in uranium rather than closer to the end of the cycle. In other words, the greatest risk is getting out too early.

On another note, take a look at the first Cameco chart above and you’ll see that come March 2003, the S&P 500 was down some 45%, whereas Cameco was up 150%.

And how did Cameco perform in the lead up to March 2000? From 1995 to 2000 it was down some 44%. From March 1996 to 2000 it was down some 76%. Either way, by 2000 it was regarded as “toxic waste” by investors (as with all uranium miners), and the rest is an enlightening history.

There’s a handful of lessons in all this:

- Even in the face of a nasty bear market you can make good money by buying “toxic waste.”

- The more ferocious the bear market the longer the duration and magnitude of the bull market that follows.

- Don’t be too quick to take profits.

Of course, it is all so easy being a hindsight genius!”

Charts 14 to 16 – Copper…

Weekly chart of copper shows the copper price rolling over.

However, we have to remember that the weekly chart was very overextended, especially when price of copper closed above $5.00/lb. Right now, I wouldn’t be surprised if copper consolidates for 4-6 weeks–maybe longer. I have no idea because–surprise!–I can’t tell the future. I wouldn’t be surprised if the price of copper pulls back to $4.00/lb even, as even then, if copper ticks that as the next low, we’d still be in an uptrend.

If you’re ever doubting the copper thesis, ask yourself one question: Is it possible for the copper supply deficit to disappear in a matter of days or weeks (or months)?

From Dan Myerson, CEO of Foran Mining (from Macro Ops)…

Now, how we’re applying our view in copper is pretty ballsy–just one junior miner. Err, one great junior miner rather. We bought Surge Copper at its cyclical bottom, and the Company currently has no warrant overhang and is cashed up and ready to power through end of 2025. I still think it is one of the safest leveraged way to play this copper cycle (although, it is a tad-bit more risky now from a technical analysis standpoint, given that the stock has started running, which means there’ve been an increase in number of buyers–meaning increase in number of potential sellers). However, when when we were buying SURG at its cyclical bottom, from a company-fundamentals standpoint, I’d argue it was probably more risky of a buy back then, since they basically didn’t have any more money to move forward, so we had no idea how much they had to dilute shareholders and at what price.

Honestly, with SURG, things went in our favor more so due to things out of our control, so the recent move up really isn’t something I can boast about. All glory to God and His sovereignty.

Lately, I’ve been seeking the Lord to get a sense of what to do with the gains I will make from SURG. Initially, I heard Him say to give it all (or at least, dedicate all the gains to present and even future giving). But I negotiated with Him, and so far we’ve come to an agreement that Steph and I can keep 15% of the gains from SURG (I tried asking for 20%, but He said no. Several times.), but the rest would be for paying taxes on the gains and for God’s kingdom. Goodbye retirement… (Not that I want to retire anyway; doing the Lord’s work, although not always easy, truly fills me with fullness of joy!)

This has nothing to do with copper, but lately, I’ve been thinking about how I will most likely plant a non-denominational church after my time in seminary, and I think the gains from SURG will definitely be used for that effort. Let’s see how things play out. I’m especially excited because I told God that if Steph and I only get to keep 15%, then you have to help me exit well. I honestly have confidence that I’ll exit SURG well, not because I’m skilled or anything, but because of faith in the character of God, that He will do it, for He will make it happen for His own sake, for His own name, for His own kingdom. Especially after all the back-and-forth negotiations we’ve been having and how… most of the gains aren’t even going to me (if I’m honest, I’ve still been struggling with this).

I digress. Lots of spiritual stuff, I know. Oh, and know that you can always unsubscribe if you think I’m crazy (I honestly am, tbh). It’s just… there is no bifurcation between secular and sacred, for all are sacred–every decision, every occurrence, and etc. Sure, there are certain techniques and signals (like technicals, fundamentals, sentiment, and etc.) to study (and I’m trying my best to maximize all those things), but even then, it is the Lord who blesses.

“The horse is made ready for the day of battle, but the victory belongs to the Lord.” -Proverbs 21:31

Wow, I digressed even more. Anyway… you don’t have to play the copper thesis the way I do. It’s high “risk,” given that I only own one name (and with high weighting!). But that’s just how I roll.

If you’re more risk-averse, you can look at COPX…

As well as Freeport-McMoRan (FCX), which is basically a slightly more concentrated copper ETF as the Company owns different copper assets in different jurisdictions…

Chart 17 – Coal’s Broken Out…

COAL ETF broke out a few days ago.

In my portfolio with Kingdom Capital Advisors, they’ve allocated 12% of my risk capital with them in Warrior Met Coal (HCC) at an average price of $64.24 (they must not think HCC was expensive even back then)…

Just food for thought.

Charts 18 to 25 – Gold, Hard Assets, and Etc…

Central banks have been decreasing their dollar holdings and increasing their gold holdings for the past decade.

Will ownership of gold get to 90% like before? Unlikely. Or, if it does, it’ll take a while.

Here’s Calvin Froedge talking about how what’s going to transpire is irreversible…

“I don’t know what the price of gold or silver does tomorrow. I don’t know how the names of my favorite commodity names are going to trade. But I do know that as time goes on, the big trends aren’t going anywhere. We’re going to keep funding obligations we can’t afford with money we don’t have. And if we don’t have it, we’re going to print it, or implement some form of capital controls or financial manipulation. What we will never do is shut off the free money fountain. There will always be an electorate that needs buying, and as long as there is a tired old mule to pull the wheel, the trend is going to continue as it has for years now – debasement, loss of purchasing power, and default by another name. So while everyone licks their wounds from today’s thrashing, let us zoom out and observe the longer term picture.

Now the narrative out in VerySeriousPeople™ land is that the Fed is committed to beating inflation and getting back to its 2% target.

The Fed balance sheet – back to May 2020…

But is that happening? Absolutely not. Inflation is still at its highest levels in decades.

Overall CPI…

CPI minus food & energy…

And why would prices be high? Maybe because despite a reduction in the Fed balance sheet, all of those dollars created since covid (about 1/4 of all dollars ever created) are still floating around.

The circulating money supply…

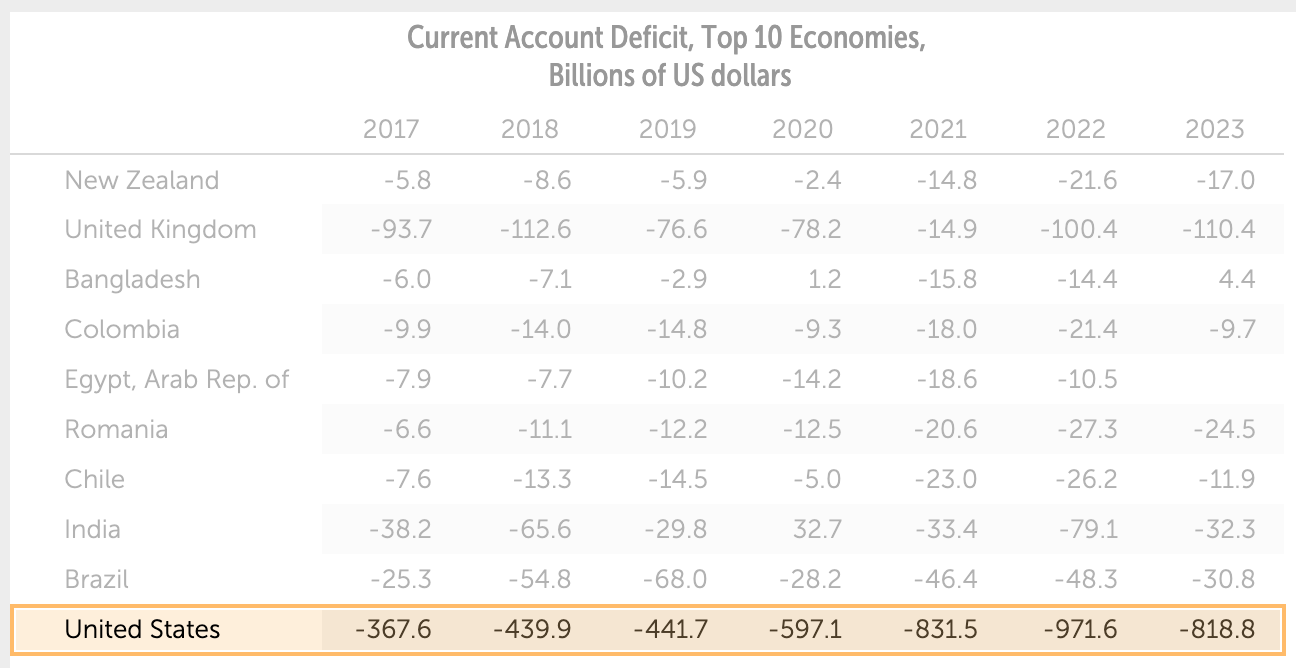

Does the Fed lower rates this year or next year? Does it matter? It doesn’t change the long term trajectory of where we are. This is where we are. The United States has $216T in unfunded liabilities. That’s $641,000 per citizen, more than the aggregate of all US national assets, and about four times all household assets. The US work force has the same number of people in it now that it had 25 years ago, with a 54 million higher population, tens of millions more not in the work force, half as many manufacturing jobs, 60 million retirees, 50 million living in poverty, 88 million people on medicaid, and another 30 million Americans turning 65 by the end of the decade. On top of these horrific demographics, we are now paying more than a tenth of the entire federal budget in just interest. We have the largest current account deficit, by far, in the entire world, while our primary rivals (Russia and China) have the largest surpluses.

So basically, you’ve got a financial system dominated by the United States, using the US dollar as the reserve currency – which is the only thing that has allowed us to push things to such absolute absurdity in the first place – and our demographics and fundamentals are terrible across the board. The argument everybody always makes is, “Well, Europe and Japan are even worse (which isn’t objectively true by very many measures), and you can’t invest anywhere else, so America is the least bad.” And those people I guess have been right in a way – US valuations are at levels seen only at the highest peaks of madness and speculation.

Which brings us to the point I had in mind when I sat down to write this article – we crossed the Rubicon a long time ago. We chose to bail out the financial system in 2008. We haven’t significantly altered policy since. This is not the 1970s. We don’t have the demographics or the balance sheet that we did then. We are not the hegemonic super power that we were in the 1990s when our only significant geopolitical rival collapsed under its Marxist economic system. We are in debt to our eyeballs, there are more dollars floating around than ever, and there is absolutely nobody in politics proposing we walk the straight and narrow back to being an austere society. There is no Paul Volcker. There is no appetite for fiscal discipline.

I can’t tell you what precious metals are going to do next week. I can’t tell you what they are going to do next month. But twenty years ago, gold was $200/ounce and we had a fraction of the debt we do today. I would bet my last chip that in another 20 years, there are going to be far more US dollars chasing fewer goods and services and roughly the same ounces of gold. AI is not going to save us. We are a society of humans, and the social obligations to those humans – i.e. unfunded liabilities – reach numbers beyond reckoning. Even if we can build robots to nurse all the old people, the amount of raw materials required to do so are going to strain all industrial supply chains.

In the case of silver and platinum group metals – not only does all the above apply – but the supply demand fundamentals are excellent as well, as I have written about on several occasions. We use more silver in industrial (primarily electronic) applications than we pull out of the ground every year. If it weren’t for melting grandma’s silverware, we wouldn’t be able to make all the solar panels and batteries that mainstream politicians across the world are demanding.

My advice is this – keep accumulating any long term, durable assets on weakness. The trajectory the economic ship is on isn’t changing. We’re headed straight for the rocks, and our life rafts are made of printed money. The promises we have made to society – i.e. all of the social obligations our budgets go towards – cannot be met through taxation or increased productivity. All of those teachers and veterans and policemen who were told they could rely on the system in their old age will only realize with time that they were sold a lie – and when it truly hits them, they’re going to be very pissed off. The long term trend that began in the 1970s and only briefly reversed will continue for as long as our current monetary trajectory does – that is, until it collapses.

Not a very cheery post, I know, but I’m not in a bleak mood at all as I write it. I am honestly expressing what my studies of history and my time as a market participant has taught me – we’re not changing course till the conditions of the system become so untenable that major political and economic changes – something powerful like a revolution, hyper inflation, or a world war – force a reset.”

Anyway, back to Cabbage here…

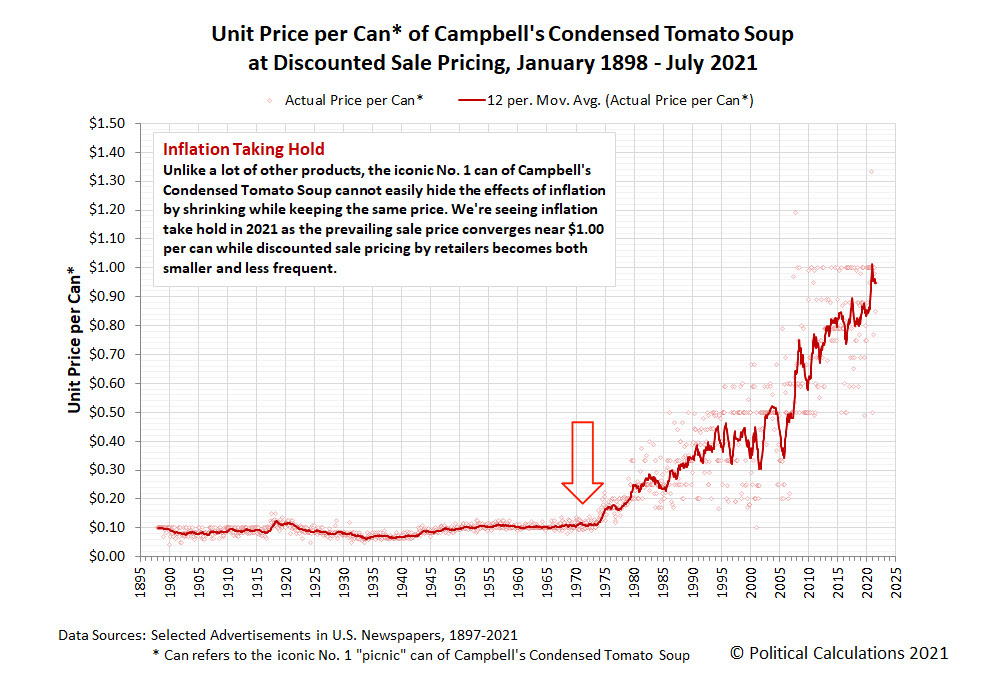

Last week, I got a $40 chicken at this Thai place for a friend. Yep, $40! In addition, I had lunch with one of my church’s youths, and my burger was $20 pre-tax. No fries (even though they used to include fries for an even cheaper price).

Inflation is hitting everyone hard. And the Fed has been fudging the numbers pretty much every month. When coffee prices increase too much, they take it out of the inflation calculations. They are basically just fudging the numbers in every CPI report, much like how the term “recession” was redefined last year.

What a joke.

Keep buying hard assets.

I really like silver at these prices (around $28/oz). As well as platinum (between $900/oz and $950/oz). Or just buy the miners. Whatever. All mining companies have risk, so definitely acquire hard assets as the core part of your portfolio. Yes, I know you will have to pay a premium, but that’s why you buy on pullbacks. Regardless, set yourself up so that you don’t get destroyed by inflation.

Sigh… the sad thing is, I hear people I love complaining about inflation, but none of them are investing in hard assets :/ While they do talk about a free 5% interest from saving, unfortunately, they are still behind the rate of inflation after paying taxes on that 5% interest.

Best of luck, everyone. Allocate your capital where capital will be treated best. That’s all I can say.

PS – Some Scripture…

What not to do…

What to do…

Disclaimer

The information contained in this publication is not intended to constitute legal, accounting, or tax advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal , accounting, or tax advice or individually-tailored investment advice should be referred to lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice.

This publication makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and is for educational purposes only.

This publication is not, and under no circumstances should be construed as, a solicitation to act as a securities dealer or adviser. The opinions expressed in the publication are those of the publisher and are subject to change without notice. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.

TO THE FULL EXTENT PERMITTED BY LAW NEITHER, ALCHEMY OF INVESTING NOR CABBAGE CAPITAL LLC, NOR ANY OTHER PERSON OR COMPANY, ACCEPTS ANY LIABILITY WHATSOEVER FOR ANY DIRECT, INDIRECT, OR CONSEQUENTIAL LOSS ARISING FROM, OR IN CONNECTION WITH, ANY USE OF THIS PUBLICATION OR THE INFORMATION CONTAINED HEREIN. ALCHEMY OF INVESTING AND CABBAGE CAPITAL LLC EXPRESSLY DISCLAIM ANY GUARANTEES, INCLUDING, BUT NOT LIMITED TO, FUTURE PERFORMANCE OR RETURNS.

No part of this publication or its contents, may be copied, downloaded, stored in a retrieval system, further transmitted, or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means, except as permitted with prior written permission.

This publication is proprietary and limited to the sole use of Alchemy of Investing subscribers. Please do NOT post this on any website, forward it, or make copies (print or electronic) for anyone else. Each reproduction of any part of this publication or its contents must contain notice of our copyright. Any unauthorized downloading, re-transmission, or other copying, modification or use of the Trademarks, this publication or any of this publication’s contents may be a violation of statutory or common law rights which could subject the violator to legal action.