Chart 1 – Broad Market…

White Line: S&P 500 Equal Weighted Index

Yellow Line: % of Stocks Above 20 DMA

Turquoise Line: % of Stocks Above 50 DMA

Red Line: % of Stocks Above 200 DMA

Bottom Pane: # of 52-Week Highs Minus # of 52-Week Lows

Even though some are still calling for a correction, what we’re seeing with breadth in all timeframes is that the recent move up in the S&P 500 is legit, as breadth has also improved. What this means is that the entire broad market is getting a bid, rather than just tech stocks. This is one of the signs of a healthy uptrend.

That said, there is currently a huge disparity between the stock market and the economy due to the acceleration of the wealth inequality and the world’s shift towards an asset-driven economy.

As the wealth inequality continues to widen, the rich will get richer, and the poor will get poorer. Money is a force and must be transferred, so rich people will continue to accumulate assets from other rich people (because rich people are the ones owning most of the assets) while the economy stagnates because the rich certainly won’t be able to increase the demand of goods and services significantly since the rich only account for a small percentage of the economy. This is especially great for the rich and especially not-so-great for the poor because the poor are the ones who are working to produce these goods and services.

Put in another way, when you hear inflation talked about in the news, they are talking about inflation of goods and services; however, they don’t look at asset price inflation. When economies are becoming rapidly more unequal, they no longer need more goods and services because ordinary people are becoming poorer. And so, you will get a natural deflation in prices of goods and services and a significant inflation in assets. This is without adding the government into the equation.

But you might be wondering… wait, deflation in goods and services? I thought you were in the inflation camp…

Well, we were talking about the economy without government intervention. However, when you add the government into the equation… what you’ll get is… more government indebtedness while the economic demand for goods and services get worse (governments borrowing money from themselves–money printing–to pay down debt, which doesn’t actually cause more money to be circulating in the economy, as well as governments partaking in fiscal spending from the money they printed, which actually does cause more money to enter into the economy and cause the inflation we typically talk about in a broad sense–rising prices of goods).

This is why regardless of what the CPI or PPI says, we all still feel like goods and services are expensive as heck. Because the government, through fiscal spending, is doing a lot of the spending for us. Of course, there are other factors as well, but I’m merely looking at the macro categories of dominant spenders and their behaviors, which in this case are the government as a whole, the rich as a whole, and the poor as a whole.

Thing is, if you can understand the spending behaviors of the large groups that actually move the needle of the economy, then the picture not only becomes much clearer but also much simpler.

That said, in addition to asset prices, home prices will also continue to increase (yep, it’s the rich who are snatching up most of the homes). We’ve already been seeing this, but it’s becoming more and more difficult for the poor or even the middle class to buy a home unless if they have money from their parents. All in all, I’m just trying to say that there will be more and more of a shift to the purchasing of assets (and real estate) rather than the purchasing of goods and services.

And so, as we’ve talked about so often, where we’re going is a world of stagflation. Buckle up because this will last quite some time. In this environment, only around 10% of the population will benefit from asset price inflation. Sure, someone who owns a house can benefit, but if you think about it, that person only benefits if they sell the house.

Get ready. Interest rates are about to get cut (because economy is crap as goods and services inflation dwindles); the money printer + fiscal spending combo is about to come into the limelight again. These forces, plus the fact that rich people are making a ton of money and buying even more assets, will really drive asset prices up. And so, this is why the ordinary economy is crap while asset prices are going through the roof. My 2-year view is a boom rather than a bust. Eventually, this charade will end, but no one knows how long the party will last.

Anyway, this is just one small piece of the macro backdrop to being long the things we’re long (nothing sectoral specific).

In our finances, Steph and I only really have around ~3% in cash, depending on how we count it. The rest are in assets–45% in the AoI Portfolio (which is mainly commodities), 30% with Smoak Capital (high-growth and special situation microcaps), 10% with Kingdom Capital Advisors, 12% in Ripple stocks. These are just rough estimates (without considering our retirement accounts).

Charts 2 to 4 – Uranium…

Uranium equities surged when Kazatomprom, the world’s largest producer, slashed its 2025 production target by 17%. Yep, and it’s a structural problem. Truth is, we don’t really need to look at the fine details to see that there is a huge issue here in the uranium supply-and-demand story.

Now is the time to continue scaling into uranium equities. Take a look below…

URNM and URNJ both with somewhat of a v-shaped recovery…

There’s really not much to say here, except if you’re underweight uranium equities, keep scaling in. If you’ve reached a sizable position, then try to balance out your portfolio.

Below is a Bank of America report on the bullish fundamentals of uranium…

Charts 5 to 11 – Gold and Platinum…

Gold is still in its parabolic move (when we are looking at it in terms of the U.S. dollar).

If you think you’re “late” to the party, just look at the gold-to-S&P 500 ratio…

Zooming out, we can get a better grasp of the cyclicality of this ratio chart…

Now, look at GDX (gold equities)-to-gold ratio…

Even though gold has been running (and the equities are the clear choice when it comes to value; although, gold equities do carry more risk, just FYI), platinum is currently even more hated.

But wait, this next chart is the ZINGER!

Anyway, just sharing all this to say, create a solid foundation for your wealth by buying stuff that can’t be printed (hard assets like gold and platinum), and then buy gold and platinum equities for upside.

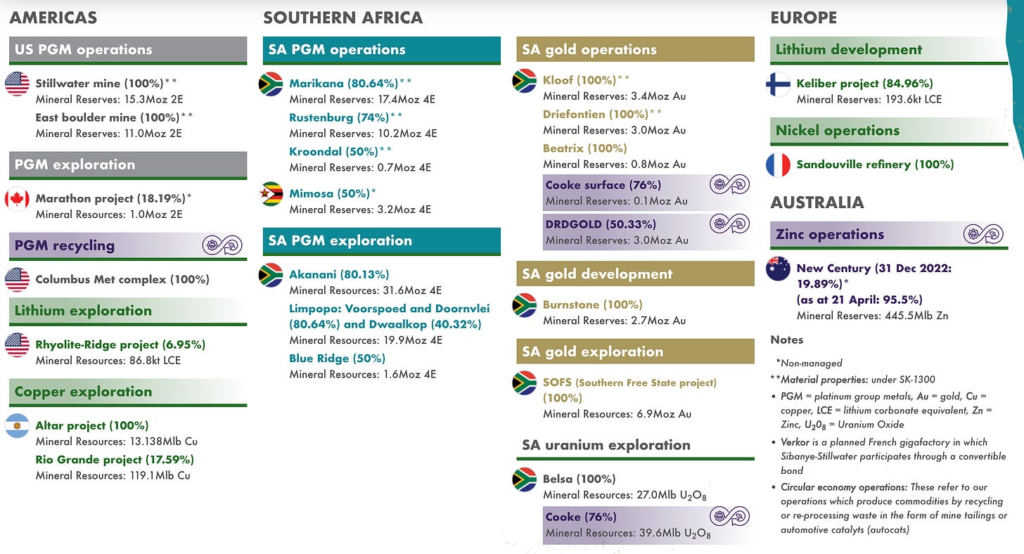

I don’t know what we’re waiting for, but SBSW is great value. Remember that 70% of the world’s platinum group metals (PGMs) is mined from South Africa, and while South Africa is a huge mess, you can basically think about SBSW as your PGMs ETF (they also have copper, gold, and uranium deposits worldwide as well). We wrote about SBSW here.

Now, here’s the cyclical bottom chart of SBSW…

Note that the monthly MACD and price momentum oscillator (PMO) are curling and seem to be inflecting.

Chart 12 – Copper…

Copper bounced at an important area where there was confluence of support. Nothing’s changed from 2 weeks ago. Just waiting.

Chart ∅ – Some Thoughts…

As of late, we’ve just been sitting on our hands and waiting for our investments to play out. There aren’t many changes we are looking to make in the portfolio, since it’s pretty much fully allocated more or less. As I continue to get income from my full time job, I’m just adding and rebalancing here and there.

If you would like help constructing your portfolio, don’t hesitate to ask for help in the Slack channel either by directly messaging me or by posting the question in the group.

I read this yesterday from investor Jason Buck, and it aligns with how I’ve been thinking about the construction of the AoI portfolio as of late…

“When I was a private investor, I was super concentrated in 2-3 stocks. All it took was one or two big winners in any given year to have a phenomenal year which I would define as a portfolio return of 75%+.

When you own a 2-3-stock portfolio, you have the time to go a mile deep into your positions. This can also become the biggest downside. The downside of super concentration is overthinking your positions. You have too much time to think about a few things.

As your capital grows it’s important to grow yourself with your capital. It’s a natural progression to add a few more positions. Why? You get better at knowing what you are looking for and waiting until you find it. You also get better at evaluating and tracking more positions than when you were younger. I feel today I can get similar performance out of 4-8 core positions (core = 10%+ positions) with less volatility and risk as I did with 2-3 core positions.

I started managing outside capital in late 2018. We normally hold 4-8 core positions (85% of portfolio) and another 4-5 smaller/tracking positions. I view our large core positions similar to veteran players on a sports team. Core positions have earned their right to their position size/salary. You’ve spent considerable time to get to know them. You’ve witnessed how the management and the business react under pressure. They’ve proven themselves and have earned your conviction and trust. The stock has rewarded you with good returns and you have rewarded the management/business with a bigger weighting in the portfolio.

For long only quality focused stock pickers, your largest positions should be the businesses you’ve held the longest that have gone up the most. It doesn’t always work out this way but directionally I think the statement is correct.

Our 4-5 smaller/tracking positions I view as our farm team/minor league team. These businesses have a majority of the elements we seek to make an investment, but they are still somewhat young, immature, and unproven. We buy a little to put them on our team, to follow and get to know the management, and give them a little playing time. The minor league is where a bulk of our turnover occurs. If the management team and business perform, we will buy more and make them a core position. If they don’t perform, we kick them off the team and replace them with other talented prospects.

Building conviction in a position is the same as building trust in a relationship. It just takes time to develop. It can’t be forced. The best relationships are built over time. The best positions are built over time.

If you are a concentrated investor that lets positions run, the larger a position becomes the more it will lead the entire portfolio up and down. Every stock has its own little bull and bear market cycle going on within its equity independent of the macro cycle. They can last for months, quarters, years, triggered by a really good or bad quarter. Hated to loved, loved to hated. Large positions can make you look like a hero in bad times (outperform during bear markets), and an idiot in good times (underperform during bull markets).

Earlier this year I had a 30% position that was down 30% YTD, and I had two 5% positions go up 100%, and I remember thinking how hard I had to work to breakeven, but that is the price you pay for concentration. It cuts both ways. I’m used to this, but you must be sure your investors understand.

An imperfect analogy might be the more you pay your superstar player the less you can pay/allocate to the other players. You also must be sure your superstar doesn’t get hurt. If you don’t get production out of your superstar, the rest of the team really needs to step up.

A few years ago, I had a phenomenal year in the market. I owned 10 stocks and 7 of them returned 100%+ in the same year. I look forward to that happening again – in my lifetime. When I looked at the attribution, I remembered thinking that it now takes a team effort to produce a phenomenal return in the portfolio in a single year. I used to go all in on one superstar, and now I build winning teams.”

PS – Some Scripture I’ve been memorizing the past 2 weeks…

Disclaimer

The information contained in this publication is not intended to constitute legal, accounting, or tax advice or individually-tailored investment advice and is not designed to meet your personal financial situation. The investments discussed in this publication may not be suitable for you. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Any areas concerning legal , accounting, or tax advice or individually-tailored investment advice should be referred to lawyers, accountants, tax advisors, investment advisers, or other professionals registered or otherwise authorized to provide such advice.

This publication makes no recommendations whatsoever regarding buying, selling, or holding a specified security, a class of securities, or the securities of a class of issuers, and is for educational purposes only.

This publication is not, and under no circumstances should be construed as, a solicitation to act as a securities dealer or adviser. The opinions expressed in the publication are those of the publisher and are subject to change without notice. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.

TO THE FULL EXTENT PERMITTED BY LAW NEITHER, ALCHEMY OF INVESTING NOR CABBAGE CAPITAL LLC, NOR ANY OTHER PERSON OR COMPANY, ACCEPTS ANY LIABILITY WHATSOEVER FOR ANY DIRECT, INDIRECT, OR CONSEQUENTIAL LOSS ARISING FROM, OR IN CONNECTION WITH, ANY USE OF THIS PUBLICATION OR THE INFORMATION CONTAINED HEREIN. ALCHEMY OF INVESTING AND CABBAGE CAPITAL LLC EXPRESSLY DISCLAIM ANY GUARANTEES, INCLUDING, BUT NOT LIMITED TO, FUTURE PERFORMANCE OR RETURNS.

No part of this publication or its contents, may be copied, downloaded, stored in a retrieval system, further transmitted, or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means, except as permitted with prior written permission.

This publication is proprietary and limited to the sole use of Alchemy of Investing subscribers. Please do NOT post this on any website, forward it, or make copies (print or electronic) for anyone else. Each reproduction of any part of this publication or its contents must contain notice of our copyright. Any unauthorized downloading, re-transmission, or other copying, modification or use of the Trademarks, this publication or any of this publication’s contents may be a violation of statutory or common law rights which could subject the violator to legal action.